- US: Markets shifted focus to US-China trade hopes, but policy uncertainty and tariff risks continue to cloud the outlook

- China: China’s recovery gained traction in 1Q25, but frontloaded exports and rising tariff risks highlight the fragility of momentum

- Indonesia: Indonesia moved to ease trade tensions with policy concessions after a temporary tariff delay, but high US tariff risks and weak external demand threaten growth

- Singapore: Singapore's core inflation has eased sharply ahead of GE 2025, raising the likelihood that MAS may shift to a neutral FX policy stance amid weak external demand and subdued price pressures

Related insights

- Singtel20 Jun 2025

- FX Tactical Ideas: USD technical rebound to be transitory20 Jun 2025

- Airports of Thailand20 Jun 2025

US: Trump-Fed tensions cool. Market focus has shifted from US President Donald Trump’s criticism of Fed Chair Jerome Powell towards renewed hopes of de-escalating US-China trade tensions. US Treasury Secretary Scott Bessent goes on to describe the ongoing tariff standoff—likening it to a trade embargo—as unsustainable and emphasises that the US is not seeking to decouple from China while expressing optimism that tensions could ease in the coming months. Trump has also raised expectations over a reduction in the current 145% tariff rate on Chinese imports, contingent on progress towards a trade agreement, and adds that he has no intention of firing Powell. Bessent also seeks to counter market concerns over a lack of direction in Trump’s agenda by sequencing key initiatives with a plan to finalise the extension of Trump’s 2017 tax cuts by Independence Day (4 Jul), followed by deregulation efforts.

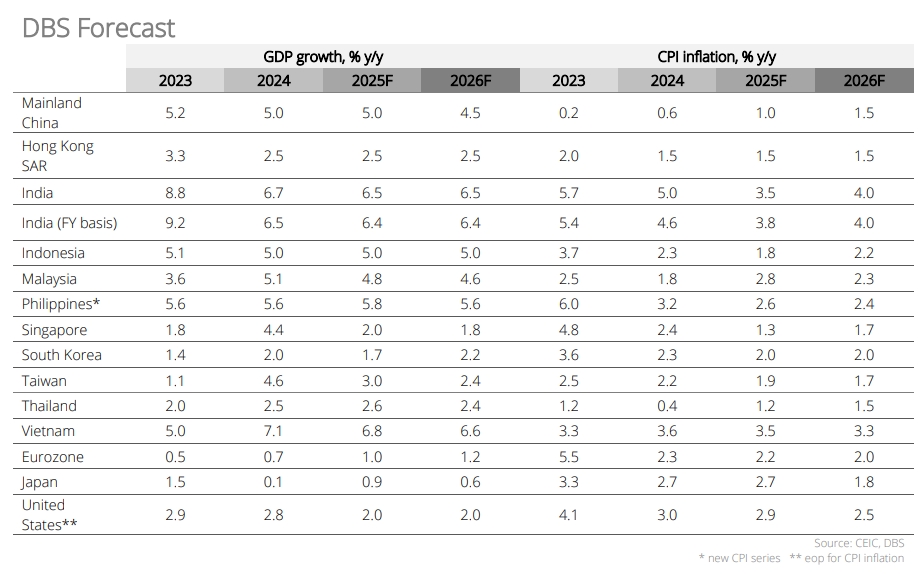

Despite the IMF issuing the steepest downgrade for US growth among the advanced economies for 2025, the US is still expected to remain the fastest-growing developed nation. Although the IMF lowered US growth to 1.8%, down from 2.7% in January, it remains slightly above the Fed’s March projection of 1.7% and higher than Canada (1.4%), the UK (1.1%), Euro Area (0.8%), and Japan (0.6%). The IMF downgraded this year’s global growth to 2.8% from 3.3%, citing rising worries over the economic fallout from escalating tariffs and trade tensions. Here, markets are paying close attention to the high-level trade talks between the US, Japan, and South Korea. While all sides are eager to demonstrate progress toward a deal, it remains too early to determine whether substantive progress can be achieved to reduce tariffs before the 90-day pause on reciprocal tariffs expires in early July.

Hence, one cannot be too confident that the Trump administration’s more measured tone reflects genuine recalibration. Instead, they were more likely calibrated for the G20 finance ministers and central bank governors’ meetings in Washington on April 23-24. Given Trump’s fixation on maintaining leverage and “holding all the cards” in negotiations, there is little to suggest a lasting shift from his unpredictable and often erratic policy approach. Against this backdrop, G20 nations face mounting challenges navigating the coming global economic and trade activity slowdown. While this week’s meetings offer a platform for dialogue, the path to meaningful cooperation will likely prove elusive. Given the competing forces at play, the recent USD sell-off may transition into a more consolidative phase rather than a sustained reversal. The tug-of-war between Trump’s unpredictable policymaking and the reality of slowing growth amid fragile risk appetite may limit clear directional conviction in the near term.

China: Growth lifts, but tariff risks loom. China’s economy grew by 5.4% in 1Q25 with a sequential gain of 1.2% q/q. The recovery showed signs of improvement across multiple fronts. External demand was helped by frontloaded shipments. Industrial output and retail sales picked up on the back of ongoing stimulus. Credit demand firmed with fixed asset investment gaining some traction. Still, mounting trade tensions pose downside risks, underscoring the need for timely policy support.

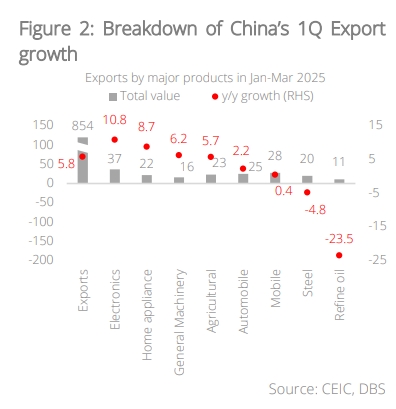

Export growth accelerated from 2.3% y/y in January-February to 5.8% in 1Q with exporters frontloading the shipments before the heightened tariff kick-in on 2 Apr. Mechanical and electrical products picked up from the moderate growth in the first two months with general machinery & equipment and mobile phone exports turning positive during the period. Agricultural products also picked up from 3.0% y/y YTD in February to 5.7% in March.

Such development cohered with the official PMI’s further improvement to 50.4 in March. Caixin SME exporter-focused index also stayed above the expansionary threshold at 50.8. Looking ahead, frontloading of electronics products would likely sustain. Exporters should speed up the shipment in view of the temporary tariff exemption.

China began 2025 on a strong footing, though this momentum now faces pressure from escalating trade tensions. The imposition of steep tariffs—145% on all Chinese imports with select products facing rates as high as 245%—will weigh on growth. We estimate these US tariffs alone could reduce China’s GDP by 2.28%. Amid heightened uncertainty, businesses may delay hiring and capital expenditures, further dampening economic activity. The sagging external sector will fuel overcapacity and, in turn, exert deflationary pressure (our estimates show that the correlation between PPI and export growth reached 0.71 during 2007–2015).

In our view, the government is likely to fast-track fiscal stimulus, including the issuance of RMB4.4tn in local government special bonds and RMB1.8tn in special sovereign bonds. On the monetary front, we anticipate further easing with a 100 bps cut to the reserve requirement ratio and a 30 bps reduction in the 1Y loan prime rate this year.

Indonesia: Trade tensions prompt concessions and policy response. News of the 90-day delay in the tariff roll-out helped improve risk sentiments in the Indonesian markets, even as the 10% baseline tariff remains in place.

Indonesia’s exports to the US amount to c.2% of GDP, amongst the lowest exposures in the region, besides the Philippines and India. While that will limit the direct impact on the economy, the significantly high reciprocal tariff rate that was announced in the first round came as a surprise. The US had announced a 32% tariff on Indonesia, influenced by the trade balance gap rather than the difference in bilateral tariff rates.

The US accounts for c.10% share in total exports, lagging China and the ASEAN-5 countries. Key exports to the US include textiles, seafood, footwear, palm oil, electronics etc. Notably, labour-intensive sectors have an outsized exposure to the threat of tariffs, especially as more than half of Indonesia’s textiles and furniture exports head to the US, along with more than a third of footwear. If the tariff rates are reimposed, there is a real risk that the impact on local manufacturing units may increase further, and these are already at risk from slowing output trends and deflationary shock from China’s exports.

Our impact analysis (if the high tariff rates are reinstated) points to a 0.5% of GDP knock-on repercussion on growth this year and about half of the scale next year, besides second order effects from slower global growth. In a fractious global economy, we expect domestic policymakers to step up on boosting demand engines.

Non-trade barriers also likely influenced the decision. The USTR National Trade Estimate Report highlighted Indonesia’s average MFN-applied tariff rate at around 8% in 2023 while expressing concerns over the progressive increase in import tariffs, cumbersome domestic tax assessment process, and rising withholding tax rates on selected imports. Additionally, it highlighted non-trade barriers such as import licensing mechanisms on agricultural products, quantitative restrictions (import limits), limited access in the pharma industry, and state trading. Local content requirements on certain information and communication technologies to sell products were also cited as a constraint, likely referring to negotiations with Apple in recent months. China’s dominance in Indonesia’s trade and investment landscape was also expected to be a potential flashpoint.

The Indonesian authorities have preferred negotiations over retaliation. Senior ministers plan to lead a delegation to meet US state officials this month, including visiting the USTR. To narrow the bilateral trade surplus with the US, Indonesia plans to step up purchases of LPG (and variants) and crude oil with more than half of LPG already sourced from them at this juncture. Coordinating Economic Affairs Minister Airlangga Hartarto suggested that SOEs may invest in the US to placate the authorities, besides potentially lowering import taxes on steel, mining products, health equipment, and electronics amongst others. The government plans to provide concessions on the trade front to provide relief to businesses according to the press, including a) tax and customs administrative reforms to reduce the tax burden by 2% (which can further rise to 30% if admin processes are further simplified), b) rate of import income Tax (PPh) will be reduced from the previous 2.5% to 0.5%, c) adjustments made to the import duty rates for products originating from the US under the MFN category (rates of 5-10% will be decreased to 0-5%), and d) export duty rates for crude palm oil commodities will be adjusted (which can potentially lower the financial burden on businesses by 5%). These changes, when approved, can result in a cumulative cost reduction of up to 14%, lowering the effective tariff burden.

Singapore: Inflation eases, MAS’ pivot in sight. Cost-of-living remains a concern for Singaporeans and in other countries, as highlighted again by Prime Minister Wong on 17 and 22 Apr 2025. While prices in Singapore are still on the rise, the pace of increases has moderated from very elevated rates with budgetary measures also providing some relief. Core inflation eased to below 1.0% y/y starting from 2025, four months before General Election (GE) 2025, trending down from 3.1% y/y in May 2024, a year before elections. We anticipate modest core inflation for the remainder of 2025, reflecting our expectations for contained imported inflation and reduced pass-through of business costs to consumer prices.

The Singapore dollar nominal effective exchange rate (SGD NEER) tends to trend higher on average in the 12 months prior to and after the GE. The appreciation of the SGD NEER generally reflects the MAS’s FX-based monetary policy stance aimed at ensuring medium-term price stability and positive capital inflows. The SGD NEER’s performance was stronger in the 2006 and 2011 cycles than in 2015 and 2020. During the 2006 cycle, the SGD benefitted from buoyant investor sentiment, backed by strong foreign direct investment (FDI) and portfolio inflows into Asian markets, alongside healthy economic growth in Singapore. Leading up to GE 2011, the SGD strengthened as the MAS tightened monetary policy to restrain rising inflation.

In contrast, during the 2015 and 2020 phases, the SGD’s trajectories were flatter with the MAS adopting looser FX policies in response to a softer economic growth outlook and receding inflation. A zero-appreciation path for the SGD NEER policy band was adopted seven months after GE 2015 and four months before the 2020 polls. Considering weaker external demand prospects facing Singapore’s economy from evolving tariff developments and downside inflation risks in the 2025 cycle, we see rising possibility that the MAS would shift to a 0% SGD NEER policy band slope in its subsequent decisions.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Singtel20 Jun 2025

- FX Tactical Ideas: USD technical rebound to be transitory20 Jun 2025

- Airports of Thailand20 Jun 2025

Related insights

- Singtel20 Jun 2025

- FX Tactical Ideas: USD technical rebound to be transitory20 Jun 2025

- Airports of Thailand20 Jun 2025